Corporate governance

Royal HZPC Group B.V. is a two-tier board company with an Executive Board and an independent Supervisory Board (SB). The Executive Board directs the Strategic Business Areas (SBAs); namely Strategic Business Area Europe, Strategic Business Development Area, SBA STET and SBA IPR and HZPC Research & Development.

| Tasks and Authorities | |

|---|---|

| Executive Board | − Informs SB about policy and general affairs. − Discusses important issues with SB. − Presents essential decisions to the SB, for approval. |

| Supervisory Board | − Maintains supervision over policy, Executive Board and general matters. − Supports Executive Board with advice. − Approves essential decisions by Executive Board. − Appoints the Executive Board. |

| General (Annual) Meeting of Shareholders | − Appoints, on recommendation of SB, members of the SB. meeting − Has authorities that are set out in law and the company’s Articles of Association. − Approves specific decisions by Executive Board. |

| Association HZPC | − Convenes general meeting of shareholders. − Owns 100% of shares. − Has certified all shares. |

| General members’ meeting Association HZPC | − Selects and appoints the Board of Association HZPC. − Approves several proposed decisions by Association HZPC. |

| Certificate holders | − Are (former) growers, (former) breeders and (former) members of staff. − Appoints Board members − Finances the business with risk capital. − Can be members of Association HZPC. |

Personal details of management structure as at 30 June 2024

Supervisory Board

| M. Kester, Chair man | Noordwijkerhout |

| C.J. Biemond | Godlinze |

| J.P. Bienfait | Amsterdam |

| I. Frolova | Utrecht |

| M. Hommes-Gesink | Lauwerzijl |

Royal HZPC Group B.V.

| Executive Board | |

| G.F.J. Backx | Chief Executive Officer |

| H. Verveld | Chief Commercial Officer |

| J.L van Vilsteren | Chief Financial Officer |

| Executive Committee | |

| G.F.J Backx | Chief Executive Officer |

| L. Escalon | Director SBA Europe B.V. |

| R.P. Graveland | Director HZPC Research B.V. and IPR B.V. |

| P.C Ton | Director STET Holland B.V. |

| H. Verveld | Director SBDA B.V., Chief Commercial Officer |

| J.L van Vilsteren | Chief Financial Officer |

| Participations | |

| HZPC IPR B.V. | R.P. Graveland |

| HZPC SBA Europe B.V. | L. Escalon |

| HZPC SBDA B.V. | H. Verveld |

| HZPC Research B.V. | R.P. Graveland |

| STET Holland B.V. | P.C. Ton |

HZPC SBA Europe B.V.

| Director | |

| L. Escalon | Director |

| HZPC Deutschland GmbH | R. Möller |

| HZPC France SAS | C. Gauchet |

| HZPC Holland B.V. | M. Jansen Klomp |

| HZPC Belgium B.V. | M. Jansen Klomp |

| HZPC Kantaperuna OY | M. Kauppinen |

| HZPC Patatas Espa | J. Luis Marti |

| HZPC Polska Sp. Z.o.o | T. Jardzioch |

| HZPC Portugal Lda | P. Simoes |

| AO HZPC Sadokas | P. Bemelmans |

| HZPC UK Ltd. | C.R. Baker |

| TLC Potatoes Ltd. | C.R. Baker |

| ZOS B.V. | M. Jansen Klomp |

| Works Council of HZPC Holland B.V. | |

| E. Meinsma | Chairman |

| P. Kreijger | Vice Chairman |

| D.Woertink | Secretaris |

| A. van den Berg | Member |

| G. Bloembergen | Member |

| S. Dijkstra | Member |

| L. Gommers | Member |

| K. Veenstra | Member |

| T. van der Wal | Member |

HZPC SBDA B.V.

| H. Verveld | Director |

| Management of Participations | |

| Solentum B.V. | H. Verveld |

| HZPC América Latina S.A | I. Ramallo |

| HZPC Americas Corp. | J. Scramlin |

| HZPC Limited | H. Verveld |

| HZPC China Limited | H. Verveld |

STET Holland B.V.

| P.C. Ton | Director |

| Management of Participations | |

| STET Potato UK | P. Hewett |

| STET France Arl. | T. Rondeaux |

| STET Russia LLC. | P.C. Ton |

| D.S.S Opslag B.V. | P.C. Ton |

Risk Management

Enterprise Risk Management

Royal HZPC Group uses the principles of Enterprise Risk Management (ERM) and sees added value in applying COSO* principles in a structured way to maintain focus and steer towards our objectives. The reporting year, therefore, saw important steps in the development of the risk framework and roadmap towards integrated risk management. By integrating risk management into our daily operations, we can take greater advantage of opportunities, implement improvements faster and reduce uncertainty regarding the consequences of our actions. This helps us achieve our goals.

We have a global presence and representation. This means that we are exposed to a wide variety of risks, where the probability and impact of the potential events may vary from one region to another. The development of our ERM framework helps us better identify, analyse and act on opportunities and risks appropriately. This enables us to do business responsibly. This is what our customers, employees, shareholders and society as a whole expect from us and we are therefore working on this with great dedication

* COSO stands for Committee of Sponsoring Organisations of the Treadway Commission. It is an organisation that develops guidelines and frameworks for risk management, internal control, and fraud prevention within organisations. COSO's most well-known framework is the COSO Internal Control - Integrated Framework, which is used to assess and strengthen internal control systems within companies. This framework helps organisations manage risk and comply with regulations, and is globally recognised as the standard for internal control. COSO additionally provides frameworks for enterprise risk management (ERM) and fraud control.

Our risk profile

In the table below, we describe four risk categories. These categories each contain themes that were identified by us in the reporting year as the greatest risks to the realisation of strategic, financial and non-financial objectives. For each theme, we describe how we regard the risk or opportunity, what corresponding action we are taking, and any developments. This profile represents the opportunities and risks group-wide.

Royal HZPC Group B.V. Risk table

Competition

The environment in which we operate can change rapidly and, with it, our competitive position. Unexpected changes may occur in terms of new market entrants, mergers and acquisitions, expansions and/or the increasing focus on sustainability issues. Change brings both opportunities and risks. If we do nothing, we may lose our competitive advantage. Sales may decline, margins may evaporate and we could fail to achieve our strategic goals.

How do we manage this risk?

Royal HZPC Group B.V. has a multidisciplinary team from Finance, R&D, Marketing and Sales that structurally monitors the competition when it comes to R&D investments (incl. varieties), M&A, strategy and entrepreneurship, model changes and market dynamics. The team reports periodically to the Executive Committee. These reports serve as input for strategic decisions regarding the various markets in which we operate.

Disruption and R&D investments

We consider R&D to be of strategic importance in achieving our objectives. Ensuring our relevance now and in the future requires having the right varieties at the right time in the different markets and geographical and climatic zones in which we operate. To do this, we must make significant investments for the future based on today's assumptions and considerations. Not having the right variety at the right time in the future could significantly hamper our activities.

How do we manage this risk?

We are developing a long-term R&D strategy. This sets out what we need in terms of talent, knowledge and skills and how we can attract, retain and develop the appropriate people. We make targeted investments in R&D and constantly seek to improve and accelerate the research process, with our focus on promoting advanced, targeted clonal breeding techniques. We regularly report on the progress. Moreover, we are trying to improve the internal feedback loop between sales, marketing, product management and research so they can respond quickly to current but, more importantly, future customer needs. We continue to invest in hybrid breeding to enable a faster breeding process. This new breeding technique will strengthen our tetraploid programme and the hybrid programme also enables the development of potato seed. We plan to start selling seed in the next five years; this will allow us to enter new markets that are difficult to reach with seed potatoes.

Local market(s)

We see huge variations in local market conditions within the sector. In this context, there is a risk that we may not be aware of the specifics of the local market and how to respond to them, or we may not be able to respond to volatile specific market situations.

How we manage this risk?

We are very aware of the differences between markets. The fact that we sell multiple varieties to multiple countries means we can cope well with local market interruptions. We spread the risk thanks to HZPC branches and collaborations with others in different parts of the world. We develop new robust varieties, collaborate with various partners and organisations and work on the interchangeability of our seed potatoes across markets. We believe it is important to be aware of the specific market requirements and regulations in order to respond quickly to changes and find solutions.

IT and security

To do our job, we need well-functioning IT systems. Interruptions, system failures and data breaches can affect business operations in general and cause sensitive business information to leak. With the ongoing digitalisation and growth of our business, we are increasingly dependent on the proper functioning of our IT landscape. This requires good security systems.

How do we manage this risk?

We have processes, policies and procedures in place to mitigate IT and security risks, including a range of preventive and detective measures encompassed within training, improving controls and monitoring. To further develop our systems, we are improving our IT Control Framework. Moreover, our new system will be designed taking into account overall IT controls to mitigate security risks. In the meantime, we conduct regular penetration tests and offer ongoing security training for everyone at our company.

Follow-up to cybercrime incident

Despite our focus on cyber security, Royal HZPC Group B.V. became a target of cybercrime in 2023. Luckily, thanks to the quick responses from various parties, the full amount was recovered. After the incident, we accelerated improvements in our IT landscape.

Production-to-sales ratio

We have to consider both market demand and the acreage planning of our growers. This means making long-term forecasts when it comes to production and sales. If this forecast is incorrect, it will have implications for Royal HZPC Group B.V.'s financial position.

How do we manage this risk?

We have to consider both market demand and the acreage planning of our growers. This means making long-term forecasts when it comes to production and sales. If this forecast is incorrect, it will have implications for Royal HZPC Group B.V.'s financial position.

Business transformation

We have to consider both market demand and the acreage planning of our growers. This means making long-term forecasts when it comes to production and sales. If this forecast is incorrect, it will have implications for Royal HZPC Group B.V.'s financial position.

How do we manage this risk?

The overarching business transformation programme 'Aurora' includes transformation in terms of our people and culture, the introduction of a new ERP system to replace the current end-of-life system still in use, and role and process harmonisation. All with the end goal of creating a more effective and efficient organisation. The regular risks associated with major programmes apply here too and are also subject to the organisation's attention. The main programme risks include budget to realisation, depletion of funds, shrinkage of scope and underperformance. The importance of adoption is also recognised. We monitor risks through periodic updates on programme performance and the extent to which deliverables have been met.

Human capital

To become and remain a market leader, it is important that we can attract, retain and develop the right staff. That is why we continue to invest in new talent and offer existing staff development opportunities.

How do we manage this risk?

The labour market situation is challenging. We maintain a presence wherever the right talent is found; an example of this is our office in Wageningen. This enables us to attract the right people to our research. The coming year will see a differentiated approach to Human Capital Management to ensure the deployment of the right person in the right job (always fit for purpose).

Variety portfolio

A healthy variety portfolio is necessary for Royal HZPC Group's independence. An extensive and diverse portfolio of varieties allows us to serve our customers as effectively as possible.

How we manage this risk?

We continuously invest time and money in developing new varieties with sustainable growth potential to expand our variety portfolio and make it future-proof. To ensure we have the right portfolio, we have improved the internal feedback loop and will continue to refine it in the future.

Internal Control

As we continue to grow, so does the need for more maturity when it comes to internal control. A lack of internal control may lead to irresponsible financial reporting, operational ineffectiveness, fraud and non-compliance with laws and regulations.

How do we manage this risk?

We pay close attention to the further implementation of internal controls and risk management within the organisation. We take action to ensure professional and structured attention is paid to risk management. We have created a dedicated business risk and compliance department to help us make the required improvements. Where necessary, we optimise our policies, procedures, standards and guidelines. The Aurora programme reinforces and supports this process.

Treasury

Our operating result is subject to treasury risk. Financial problems encountered by customers and/or in specific countries may lead to financial losses for Royal HZPC Group B.V. Cash flow risks and currency risks need to be managed and continuity of funding also falls under Treasury risk.

How do we manage this risk?

Our operating result is subject to treasury risk. Financial problems encountered by customers and/or in specific countries may lead to financial losses for Royal HZPC Group B.V. Cash flow risks and currency risks need to be managed and continuity of funding also falls under Treasury risk.

Reporting and publication

To make informed decisions and comply with legal and statutory requirements, we need reliable reports and analyses. Preparing reports and analyses currently requires a great deal of manual work. In our next reporting year, the manual work should lessen and there will be more automated generation, which will reduce the estimated probability of the risk manifesting.

How do we manage this risk?

We are working on the implementation of a new ERP system, which will give us the option to filter data in a user-friendly way for reporting purposes. We will implement (functional) risk and control requirements in the ERP system through collaboration with our internal control manager in the ERP project, and improving data quality and availability. We are using a new consolidation tool, which will be rolled out to the countries in the coming year to improve regular reporting.

Moreover, policies and procedures, as well as the overarching management manual, have been updated. In the future, we hope to have an ERP that supports us in generating real-time, up-to-date reports and an ERM framework which allows us to make a statement on the current level of procedural effectiveness.

Compliance with laws and regulations

The Royal HZPC Group B.V. is increasingly subject to audits and controls. Compliance with financial laws and regulations is important and banks and auditors take us to task on this. We are also seeing major developments with regard to non-financial laws and regulations and social supervision, for example in the field of sustainability. The importance of being compliant with our policies, laws and regulations as the key 'hygiene factor' for our business falls within the scope of this risk.

How do we manage this risk?

In recent years, we have established a business risk & compliance department which actively supports awareness of compliance issues in the organisation. It also enables us to resolve compliance issues more quickly, especially where third-party payments and internal irregularities are concerned.

At HZPC, we are constantly looking for opportunities to create solutions and, in line with this value, we have reviewed and updated our policies and procedures where necessary, following the recommendations of an external consultant. Our commitment to knowledge and personal development drives us to continuously improve these processes, procedures and controls.

We have also held awareness sessions on relational due diligence, with a specific focus on ‘Knowing Your Customer'. These efforts reflect our responsibility to get to know our business contacts properly and will be continued and extended to ‘Knowing Your Agent' and ‘Knowing Your Supplier'.

We are committed to achieving our goals and our approach is based on conscious risk taking, underpinned by our thorough country risk analyses. This is an expression of our commitment to building long-term relationships and taking responsibility for our actions. At HZPC, we strive to maintain the highest standards.

Infringement

There is a risk that we could be unable to protect our intellectual property rights because competitors abuse our rights or produce derivative varieties.

How do we manage this risk?

We work to protect our varieties in the various countries in which we operate and where varieties can be protected. We constantly monitor the market. In Europe, we are shareholders of Breeders Trust, which protects intellectual property rights and takes legal action where necessary.

We tailor the enforcement of our rights to the market in which we operate. In regions where we cannot rely on a robust jurisdiction to protect our rights, we do our utmost to document the trail and presence of our genetics to maximise the control we have.

Results, investments, financing

Investments

Also this year, despite the economically uncertain environment, we invested in our business and continue to do so. The construction of the R&D facility is now complete and will be officially commissioned in 2023/2024. We began preparations last year for the construction of a minituber facility in France. In addition, we have invested in our minituber facility in UK.

Total invested capital (total fixed assets) at the end of fiscal year 2023/2024 is EUR 42.7 million, which is EUR 6.3 million higher than last year. For next year, we expect a similar amount of investments. An important part of this is the Aurora program. In Aurora, we are adapting processes and replacing the old ERP system. This investment in Aurora is in addition to the regular replacement investments in operations and R&D.

Liquidity

The cash position improved compared to last year. The current ratio is unchanged from 1.2 last year. The quick ratio (current ratio excluding inventory) is unchanged from 1.2 last year. Looking to the future, we do not expect any major changes here.

Results

Net turnover of EUR 415 million was recorded in the past year. Like last year, more than 85% of the turnover consists of seed potato trading. Sales were lower as Royal HZPC Group B.V. mainly achieved higher prices. Licence income increased from EUR 24.5 million to EUR 25,4 million. The organisation's gross margin, i.e. the sum of operating income minus the sum of costs of raw and auxiliary materials and third-party services, freight and loading charges and packaging, decreased to EUR 67,3 million. This is due to lower revenues which were not fully offset by higher prices. By paying close attention to costs, a net profit before deduction of costs of the Connecting Growers programme of EUR 6.1 million was achieved.

As yet, there are no expectations of the result for the coming season due to major uncertainties. These uncertainties are caused by uncertain yield expectations and the corresponding availability for different markets. In addition, uncertainty remains high due to the geopolitical situation.

For our workforce, we don't expect any major changes either.

Financing

Huge changes have affected the financing structure this year. We concluded an increase and extension of our financing agreement as of March 2024. In the process, the consortium expanded from two banks to three banks. The banking consortium now consists of ING Bank N.V., Commerzbank Aktiengesellschaft and Crédit Industriel et Commercial, Succursale de Bruxelles.

Solvency increased from 39.6% in 2022/2023 to 44.7% in 2023/2024. Last financial year, turnover fell and the margin deteriorated slightly. This year, the shortage of seed potatoes had a big impact on our buyers.

Costs were up due to higher volumes and cost increases due to inflation. As for the debtor position, we have seen a strong improvement and this is reflected in the balance sheet. However, we have recognised a higher provision for a debtor from Syria and another from Sudan. The latter is mainly related to the war situation in these countries.

The management team is constantly assessing the relevant information and risks in order to take the appropriate measures. The new financing facility we now have is sufficient to continue paying out advances to growers and finance further growth. The current facility is also sufficient to absorb future regular fluctuations and disruptions in customer receipts. The management team constantly monitors developments in turnover and costs in order to maintain an overview of liquidity developments. Analyses are also carried out on a regular basis so that additional measures can be taken in good time. On the basis of the management analyses, the current results and the company’s financing position, the annual accounts have been drafted on the basis of an assumption of continuity. Based on an updated forecast in September 2024, we expect to have sufficient funding until at least March 2028 and to be in compliance with the bank's covenants.

Remuneration policy and personnel matters

Our employees are crucial to achieving our strategic goals. Adequate personnel policies and market-based remuneration policies enable us to attract and retain staff. We use a range of different tools for this purpose.

Last year, there were no changes in the remuneration and remuneration policy for directors and/or supervisors. Once every five years, the remuneration of the director and/or supervisors is benchmarked by an external agency.

Employees make an important contribution to the success of the company and, last year, we were able to attract great people. Some employees also left. We have been able to fill the vacancies that have arisen plus the additional positions created by business growth, although vacancies tend to be open a little longer than during previous years. We expect personnel numbers to remain the same or rise slightly.

Diversity

Royal HZPC Group B.V. stands for Diversity, Equity and Inclusion (DEI).

We are committed to a diverse workforce and an inclusive environment where everyone feels valued and respected. In addition, we support a corporate culture where everyone feels encouraged to (continue to) develop and grow. Or, in other words: Guiding continuous growth.

We actively seek to attract, employ and retain people from diverse backgrounds. As a result, our workforce is increasingly reflecting the rich diversity of the societies in which we operate. Our commitment to diversity extends to all levels of the organisation, from entry-level positions to management positions. The diversity dimensions on which Royal HZPC Group B.V. intends to report are:

1. Gender diversity (female/male representation

2. Age diversity (representation of different age groups)

3. International diversity (number of nationalities of our colleagues)

4. Knowledge diversity (distribution of our workforce by clustered subject areas)

5. Equal pay for men/woman

In addition to these diversity dimensions on which we report, Royal HZPC Group B.V. also stands for:

6. Labour market diversity (removing barriers to/promoting participation of colleagues with an occupation disability)7. Ethnic and cultural diversity (promoting the representation of different ethnic and cultural groups)8. LGBTQ+ diversity (welcoming anyone regardless of sexual orientation)Philosophy of life (allowing for differences in terms of faith of philosophy of life)

We do not report on the representation of these groups within our workforce.

Gender diversity targets have been set for the composition of the management (Supervisory Board and Executive Board) and (Managing Directors of the SBAs) of the organisation.

Gender diversity targets have been set for the composition of the management (Supervisory Board and Executive Board) and (Managing Directors of the SBAs) of the organisation.

Management layer | target | To be realised by: | Explanatory notes: |

SB | 20% of members are of the 'opposite sex'. At least 20% female and at least 20% male | Realised | Target was realised in financial year 2023-2024. The SB has 2 women and 3 men, i.e. more than 20% of the 'opposite sex'. In future replacement, efforts will be made to continue to achieve the targets. |

Executive Board | 20% of ExBo are of the 'opposite sex'. At least 20% female and at least 20% male (current situation: 3 men) | 1-1-2028 | Target was not realised in financial year 2023-2024. In future replacement, efforts will be made to achieve the targets. |

Managing Directors SBAs | 20% of Managing Directors are of the 'opposite sex'. At least 20% female and at least 20% male (current situation: 4 positions, including 3 men as Managing Directors and one vacancy). | 1-1-2028 | Target was not realised in financial year 2023-2024. In future replacement, efforts will be made to achieve the targets. |

Equal and fair treatment

We are accountable to the principles of fairness, impartiality and justice. Our aim is to provide a working environment where everyone has equal access to professional and personal growth. To the extent that there are barriers to these principles, we want to remove them.

Our Code of Conduct describes how to deal with (perceived) unequal treatment.

Inclusion

For us, inclusion means promoting a sense of ‘belonging’ and creating a culture where everyone feels properly rewarded, respected and valued. Our mission, vision, corporate values and goals should be unifying. Within this context, we encourage open dialogue, active listening and mutual respect for everyone's unique contribution to the whole. We recognise that inclusive teams are more innovative, productive and better able to achieve our shared goals.

General

Our commitment to DEI is in line with international (including European) laws and regulations promoting equality and non-discrimination in the workplace. We focus on adhering to the principles set out in the various international guidelines within the countries where we are based. We understand that building a diverse, equitable and inclusive organisation is a journey that requires continuous effort and improvement. We will discuss the objectives internally so that they are known to everyone. Based on insights gained, we will make arrangements with Staff Representatives to refine our practices and policies.

Share certificates

Royal HZPC Group issued 783,725 shares with a nominal value of EUR 20. HZPC Association (Vereniging HZPC) owns 100 percent of the shares and has certified all the shares. The certificate holders form a closed group, the members of which have to comply with specific requirements. All certificate holders have a business agreement with Royal HZPC Group B.V, or have had one in the past.

Connecting Growers

Twenty years ago, almost all certificates were in the hands of active growers. This has now fallen to around half. This is because many growers, who are no longer actively involved in growing, hold on to their certificates and in the past have rarely offered them for sale. At the same time, active growers purchased few certificates. Thanks to the Connecting Growers programme, share certificates are increasingly coming into the hands of active growers. For this purpose, Royal HZPC Group B.V. bought EUR 1.5 million worth of certificates in 2023-2024. These were donated free of charge to growers with a seed potato contract with Royal HZPC Group B.V. in the EU. The majority of our active European growers now hold certificates. Read more at: https://www.hzpc.com/en/about-us/association-hzpc/connecting-growers.

Share trading platform

Share certificates used to be traded on an internal market. Since the trading period in May 2022, Royal HZPC Group B.V. has operated a new trading system for trading in certificates. Twice a year, in May and November, certificate holders can trade HZPC certificates for 10 working days on the Captin trading platform; Captin is an AFM-regulated brokerage firm. Royal HZPC Group B.V. has thus become a semi-listed company that is obliged to abide by the Dutch Financial Market Authority (AFM) rules. The market has also become more transparent and the rights of the certificate holders align with the regulations that govern the regular market. The range within which trading takes place is 20 percent (rather than 10 percent), so the market balances faster. During these trading periods, Royal HZPC Group B.V. purchases certificates for the Connecting Growers programme in addition to the certificate scheme for staff.

The certificate holders receive information about Royal HZPC Group B.V via press releases, the Annual Report and the HZPC website. In addition, Dutch certificate holders receive the company’s client magazine ‘Ruggespraak’.

Market table

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 | |

|---|---|---|---|---|---|---|---|

| Profit per share certificate (x EUR 1)* | € 6,00 | € 11,93 | € 1,49 | € 1,74 | € 9,00 | € 9,01 | € 7,79 |

| Dividend per share certificate (x EUR 1) | € 4,00 | € 7,75 | € 1,00 | € 1,00 | € 6,00 | € 6,00 | € 5,20 |

| Dividend as % of net result | 67,00% | 65,00% | 67,00% | 57,00% | 67,00% | 67,00% | 67,00% |

| Rate as of 30 June (x EUR 1) | € 200,00 | € 162,00 | € 131,25 | € 106,35 | € 76,60 | € 76,27 | € 102,46 |

| Dividend as % of rate | 2,00% | 4,78% | 0,76% | 0,94% | 7,83% | 7,87% | 5,08% |

| Return on shares (x EUR 1) | € 38,35 | € (30,25) | € (29,75) | € (23,90) | € (23,75) | € 5,67 | € 31,39 |

| Total shareholders return in % | |||||||

| (as of 30 June of the previous year) | 23,15% | -15,13% | -18,36% | -18,21% | -22,33% | 7,40% | 41,16% |

| *exclusive costs of Connecting Growers |

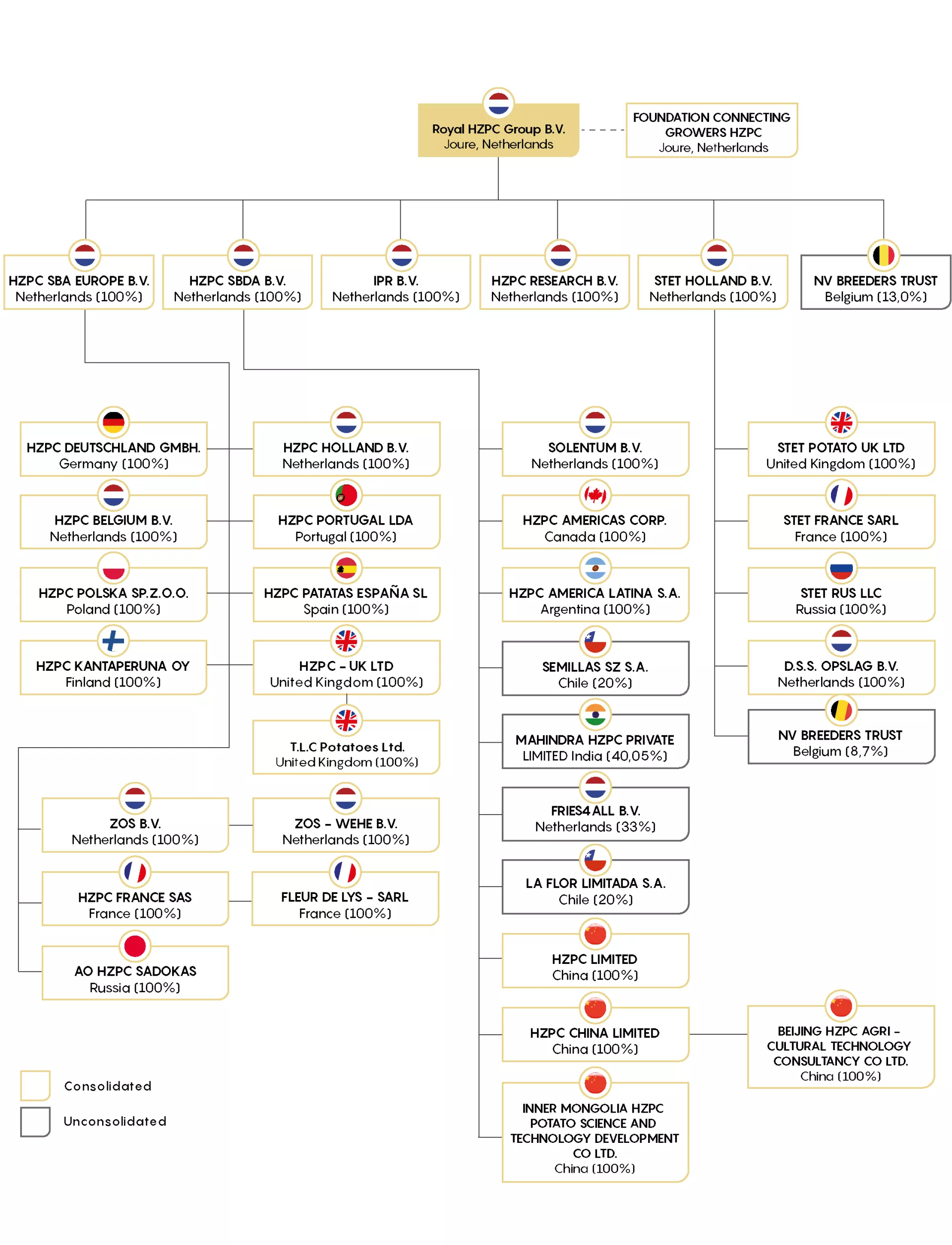

Group structure

Partner in the picture

Partner in the picture - Dirk Brust

Senior relationship manager Food & Agri at ING Netherlands

As senior relationship manager, Dirk Brust is the point of contact for all financial and strategic issues facing wholesale Food & Agri relations. ING Netherlands has been the house bank for Royal HZPC Group B.V. for about a decade. Dirk has been involved with the company, in various roles, since 2007.

Compliance in general requires increasing attention, and this applies within Royal HZPC Group B.V. too. "As banks, we have a ‘gatekeeper’ function in this. This is simply regulated by law. We are a financial services provider, but also a regulator at the same time. And that is not surprising when you consider that all financial transactions converge at a bank.

This involves complying with laws and regulations and countering financial economic crime. You don't want to finance terrorism, or enable money laundering or tax evasion. It also concerns companies you'd rather not do business with because working conditions are poor or because they harm the environment, for example. So we oversee many different facets by constantly monitoring data and looking at which parties are involved, where the money comes from and where it goes. This role has become much more relevant in the past few years. You may have your own opinions on that development but its purpose is very clear: we want to protect our customers and maintain trust in the economic system."

The spotlight is increasingly falling on payments from high-risk countries, so-called 'ultra-high risk countries'. Partly as a result of laws and regulations, ING does not wish to (and cannot) conduct this kind of transaction. But you must make robust agreements with each other in this context, i.e. what can and cannot be done, and this subject regularly comes up for debate. Royal HZPC Group B.V. has significantly tightened its policy on this issue.

"In 2023-2024, Royal HZPC Group B.V. encountered cybercrime. ING does its best try to protect customers from this type of event but, if things do go wrong, it is crucial that you take immediate action. As a bank, we were an important link in the process, and liaised with the bank which received the money. We were able to secure it quickly as a result and ultimately return it to Royal HZPC Group B.V. Fortunately, this is still the outcome in many cases."

We thus continue our long-term and enduring relationship with Royal HZPC Group B.V... And are delighted to do so

"We see ourselves as Royal HZPC Group B.V.'s principal bank and feel proud to have that role. This company is a wonderful knowledge-intensive organisation that has become a market leader thanks to professionalisation and internationalisation. We are part of a consortium of banks providing financing to Royal HZPC Group B.V. Refinancing was completed in 2024 and Commerzbank AG and the Crédit Industriel et Commercial, together with ING Netherlands, form the corresponding financing consortium. We thus continue our long-term and enduring relationship with Royal HZPC Group B.V. and are delighted to do so. It is great to be able to contribute to the future of Royal HZPC Group B.V. as a bank."